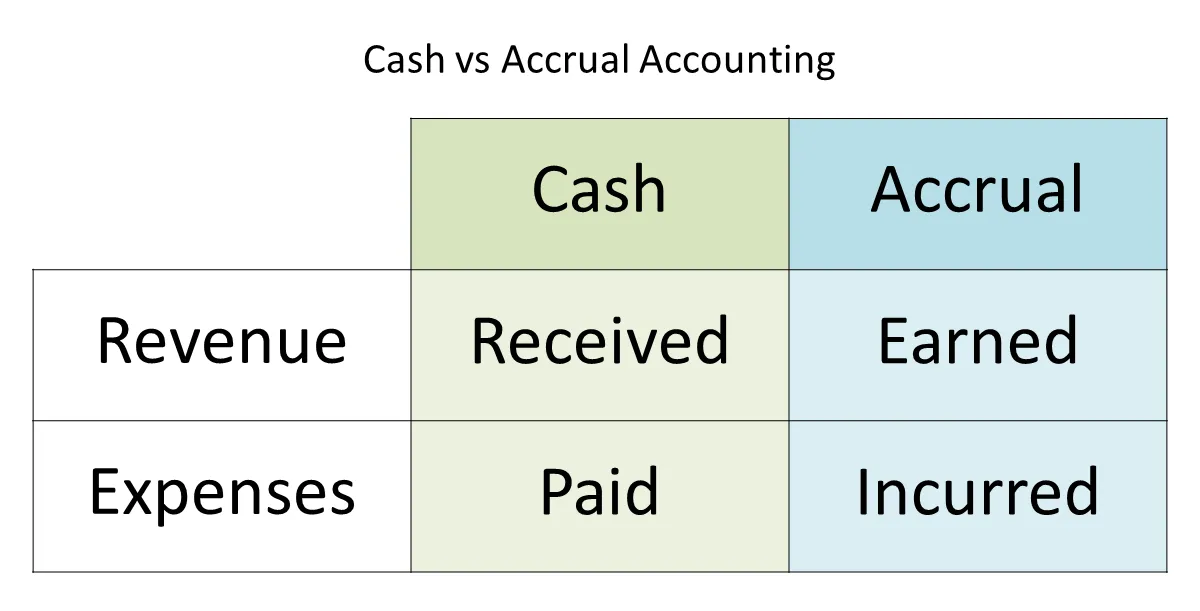

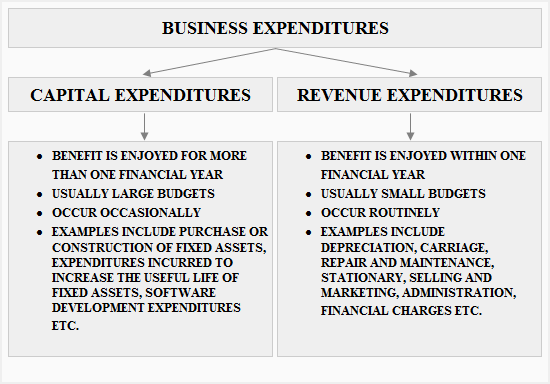

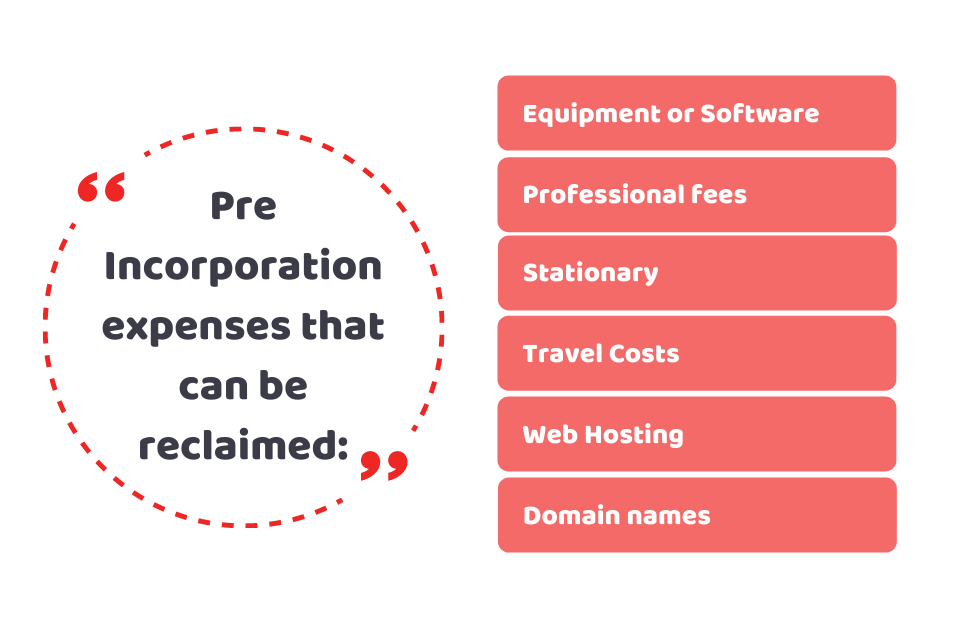

Starting a business seems to be quite interesting but running it properly and hassle free really requires a lot of hard work, dedication and patience. To remain hassle free and for healthy business; every business owner should follow the correct compliances like GST filing, TDS, Return Filling, ROC etc. The first and foremost compliance which requires to be followed by every startup no matter the size is the “Accounting”. Every business owner hires an accountant, but there always lies some lacuna of accounting knowledge resulting in misrepresentation, fraud and error. Many failures have been noticed in a small businesses or start-ups due to lack of proper bookkeeping. Poor record keeping can cost a business a lot of money which is the first step to ruin many small businesses or entrepreneurs. Accountzontrack helps start-ups to correct the accounting and have seamless reports to make decision and to know how the business is performing.  1. Method of Accounting – Cash vs. Accrual For every startup, money which comes in is treated as income and money going out from the business is an expense. In other words, a cash method is followed where income and expenses are tallied and the difference arising is considered either as profit or loss to the business. For Example: As per the thinking of a small business, a motor car purchased for the business is an expense for the company since at the time of purchasing a motor car , they have to pay money and hence money goes out from the business. But, in reality, Motor Car is not an expense for the company and the expense incurred is not debited to the profit & loss account. It is shown in the Balance sheet under the head Fixed asset. This suggests to us that the accrual method of income is followed. This means that expenses are recorded when payment is made but income is recorded when a sale occurs and not when payment is received.  2. Irregular Updates and Updates in un-synchronized mannerKeeping the accounts of the business updated on a regular basis is a very difficult task and because of the frustrating nature of keeping accounts, many businesses/ start-ups do not update their accounts on a regular basis. This results in forgetting transactions and missing them completely from the accounts books. So, to overcome this problem small startups start jotting down their transactions in an excel sheet which is very time consuming. This also results into misclassification of ledgers and expenses and non compliance of accounting policies. But, as per our view, maintaining day to day updates of accounts is not at all a difficult task. Various accounting software like Tally is used to keep this task hassle free. Also, nowadays various tally versions like Tally 5.4, Tally 9, and Tally Erp are used to simplify the work of accounting. But, the startups are not aware of this knowledge.  3. Personal Expense of the directors booked into Company’s account Every startup sometimes thinks that all the expenses incurred by the director are regarding the company’s business. This is not the case in every transaction that the director makes. This is the reason many times personal expenses of the director are booked in the company’s profit and loss statement. Personal Expense of the director so booked will not be allowed as deduction while filing the company’s return of income.  4. Treating loan given to company by director as Share Capital Many times the loan given to the company by the director for the expenses of the company is treated as share capital. The entrepreneurs think that an expense met by them is for the company so it is nothing but the capital given to the company. But, this is totally wrong as the share capital is the amount contributed by the director to open a business. In order to open a company, a minimum funds is required to be deposited which is treated as the capital of the business. Whereas, the loan given by the director will be treated as Loans and Liability under Current Liability. And when the loan is repaid by the company to the director for the expenses met by him, then the same loan will get cancelled off, and the net effect will result in the expense.  5. Revenue Expenditure vs. Capital Expenditure A capital expenditure is an amount spent to acquire or improve a long-term asset such as equipment or buildings and is incurred to increase the earning capacity of an existing fixed asset whereas revenue expenditure incurred on fixed assets include costs that are aimed at ‘maintaining’ rather than enhancing the earning capacity of the assets. These are costs that are incurred on a regular basis and the benefit from these costs is obtained over a relatively short period of time. Routine repairs are revenue expenditures because they are charged directly to an account such as Repairs and Maintenance Expense. Also, the revenue expenditure incurred by one company may be treated as capital expenditure for another company. For Example: Server Maintenance expense at one time may be treated as revenue expenditure if it is incurred for maintenance purpose whereas it may be treated as capital expenditure for a business engaged in Server Hosting.  6 .Treatment of Pre Incorporation Expenses All the expenses incurred in relation to the incorporation of a company are treated as Pre incorporation expense. As per Income tax Act 1961, following are treated as pre-incorporation expenses:Preparation of feasibility and project report;Conducting market survey or any other survey necessary for the business of the assesseeConsultancy fees;Legal charges for drafting the Memorandum and Articles of Association of the company;Printing of the Memorandum and Articles of Association; Fees for registering the company under the provisions of the Companies Act, 1956;In connection with the issue, for public subscription, of shares in or debentures of the company, being underwriting commission, brokerage and charges for drafting, typing, printing and advertisement of the prospectus; etc.  7. Tax Compliances Generally startups do not do proper compliances of TDS, Service tax, Advance tax, applicability of different taxes, statutory audits under different Acts, unawareness of sections of different Acts which may be applicable on them.  To Conclude: So, the startup should look for professionals’ services in their initial stage and should consult them regarding accounting and compliances of law. |